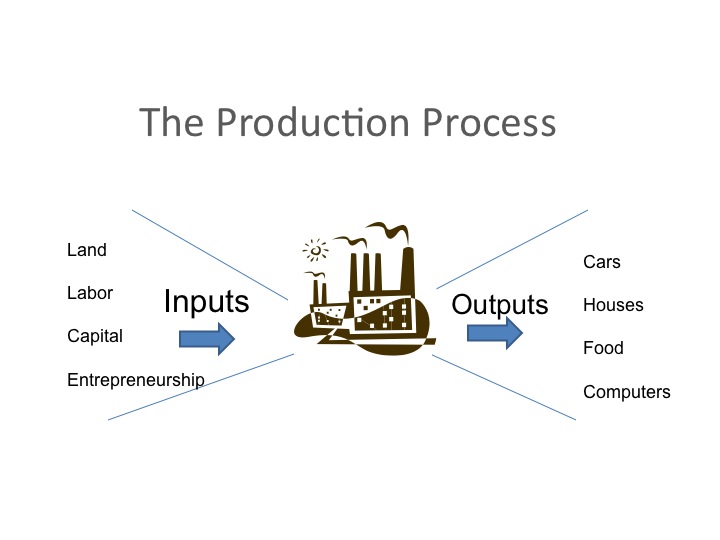

Section 01: The Production Process

The production process involves converting resources (aka: factors of production, or inputs) into goods and services.

There are four main categories of resources: land, capital, labor and entrepreneurship.

1. Land

All natural resources both above and below the ground are part of the land resource including farm land, animals, forests, water, minerals, and air. For the use of these resources, businesses pay a rental income.

2. Capital

Capital includes man-made items such as buildings, machinery, and equipment. Unlike consumer goods that directly satisfy our needs and wants today, capital goods, such as machinery, increase our future productivity which then allow us to produce more of the goods and services we want in the future. Interest income is the return or payment for the use of capital. Note that while money is often called capital, it is not an economic resource but simply enables or facilitates the purchase of one of the resources.

3. Labor

The labor resource includes both the physical and mental contribution of a worker. As a return for the use of their labor, workers are paid a wage. Education and job training increase the productivity of the labor resource and thus increase wages – as we’ll see later in the course.

4. Entrepreneurship

The last resource is entrepreneurship, which combines the other resources and provides a good or service. These individuals take risks and are rewarded with profits when their ideas are successful.

All inputs or factors of production can be categorized into one of these four resources.

Practice

See if you can classify each of the following resources. Do any of them fit into more than one category?

| Land | Capital | Labor | Entrepreneurship | |

| Crude oil | ||||

| A worker in a General Motors plant | ||||

| Wind | ||||

| A copy machine | ||||

| An irrigation canal | ||||

| Bill Gates | ||||

| A windmill |

Circular Flow and the Market System

Every society faces some key questions: What goods and services to produce? How to produce those goods and services? and for whom? How a society chooses to answer these questions will in a large part determine the prosperity of the society, its distribution of wealth, and the variety of products and services available. Societies answer these questions either through a decentralized system using markets, a command or central system using government planning, or some combination of the two.

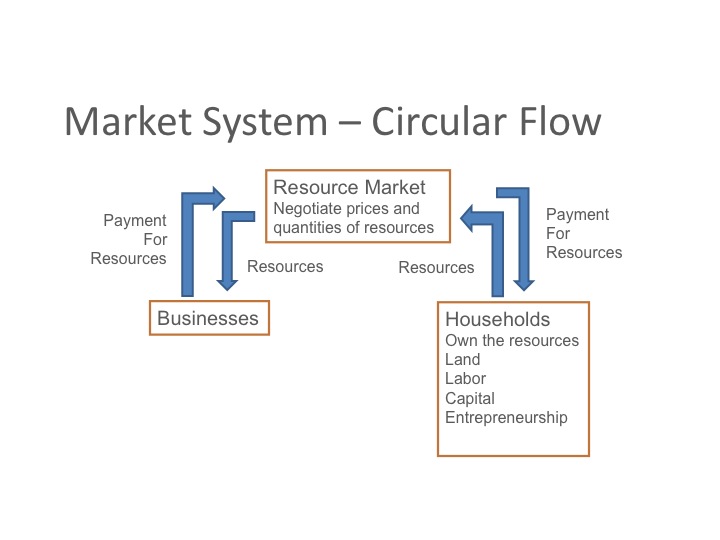

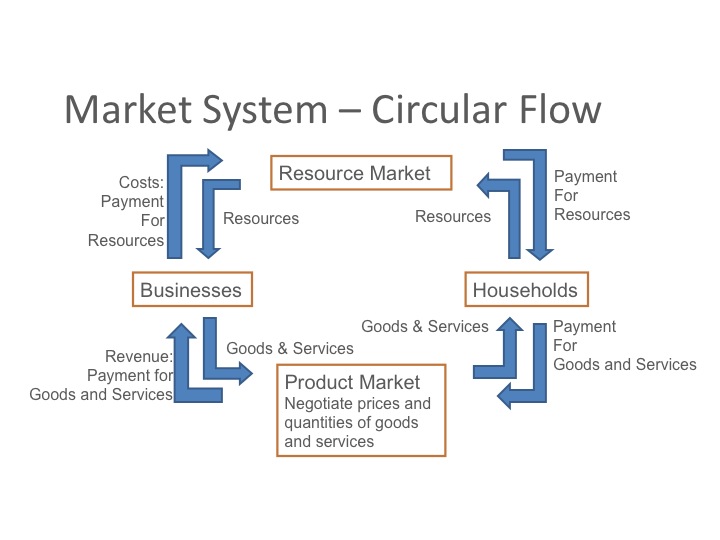

In a market system, the households own the resources and willingly supply those to businesses in the resource market in return for a payment for the use of those resources. Remember that households are paid wages for their labor, interest for their capital, rent for their land, and profit for their entrepreneurial ability. Businesses are willing to purchase the resources, provided they can convert them into goods and services that will return at least a normal profit. The quantities and prices of resources are determined by the supply and demand of the resources in the resource market.

Households use the payments they receive from the use of their resources to purchases goods and services that businesses produce. The provision and purchase of goods and services takes place in the product market. In the center ring is the flow of resources and goods and services, while the outer ring is where the monetary transactions take place. In this simple circular flow diagram, we see the basic flows and workings of a market economy.

There are three main questions that market systems answer for a society.

1. What to produce?

2. How to produce?

3. For whom to produce?

Capitalism is a market system that relies on private property and the use of markets to answer the societal questions of what to produce, how to produce it, and for whom. A key feature of capitalism is that individuals act in their own self-interest as they seek to improve their well-being. Households willingly supply their resources so that they can purchase goods and services which they value more. Since consumers are able to purchase the goods and services they want, they vote with their dollars and signal to the market what is of value to them. If a business is not producing what is in demand, they will find that they are better off to use their resources producing something else that consumers want. Thus in a market economy, the consumers are the ones that ultimately determine what will be produced.

Under capitalism, individuals are rewarded for their contribution based on how society values that contribution. This is one reason why the church strongly encourages each member to get a good education. While pure capitalism rewards individuals for their contribution, individuals are also exposed to the risks of the market if they are not producing what consumers want. This provides an incentive to work towards best meeting the needs and wants of consumers, but it also can lead to a wide variation in the distribution of income.

Consider the highlighted sentence in the following quote by President Hinckley:

Get all the education you can. I repeat, I do not care what you want to be as long as it is honorable. A car mechanic, a brick layer, a plumber, an electrician, a doctor, a lawyer, a merchant, but not a thief. But whatever you are, take the opportunity to train for it and make the best of that opportunity. Society will reward you according to your worth as it perceives that worth. Now is the great day of preparation for each of you. If it means sacrifice, then sacrifice. That sacrifice will become the best investment you have ever made, for you will reap returns from it all the days of your lives."http://www.providentliving.org/content/display/0,11666,2884-1-1161-1,00.html--Gordon B. Hinckley, Teachings of Gordon B. Hinckley, 172–173.

As Adam Smith outlined, each person seeking their own self interest in turn promotes the best interest of society by producing those goods and services most desired, all as if by an invisible hand. According to him, each individual, seeking only his own gain, "is led by an invisible hand to promote an end which was no part of his intention"--that end being the public interest.

The view of capitalism is that markets function without government control, thus it does not need government intervention. The term Laissez-faire is French, essentially meaning leave it alone. Under capitalism, businesses have an incentive to always produce in the least cost manner. If they are not producing in the least cost manner, another business would be able to produce the product at a lower cost, undercut the competition, and take away sales. As new technologies are developed, firms have an incentive to adopt the technologies if doing so will allow them to produce at a lower cost. With the use of the markets, goods and services will be distributed to those who are willing and able to pay the market price; thus, the market price serves as the rationing mechanism, determining who gets the product.

An alternative economic system is socialism, in which the government seeks to use the nation’s resources for all of its citizens, instead of letting the citizens use the resources in the manner they best see fit. Thus, under socialism the government owns or controls the property and answers the three questions of what to produce, how to produce, and for whom. There are different degrees of socialism, one being Communism, that was envisioned by Karl Marx consisting of collective ownership of resources and decisions made by central planning committees. Under socialism, there is one pie that is divided among all of the citizens. Unfortunately, central planners with the best intentions may not be able to represent each individuals preferences in their choices. Because of scarcity, central planners must decide not only what to produce, but also how to ration the produced goods and services among the various consumers (recall there will always be unlimited wants and limited resources). The difficulty of determining who gets a product is often lost on the casual observer of centrally planned economies – but this is one of the most difficult decisions that has to be made – who will go without! Winston Churchill stated: “The inherent vice of capitalism is the unequal sharing of blessings; the inherent virtue of socialism is the equal sharing of miseries.”

Most countries in the world, including the United States, use a mix of private and government enterprises to allocate the nation’s resources in providing goods and services. These mixed economies rely on the private market to produce and allocate certain goods and services while the government controls the provision of other goods, such as welfare and Medicaid in the United States.

As members of the Church, we recognize that there will some day be an economic system in place that will be uniquely different from the current economic systems of today.

That system is sometimes referred to as "The United Order."

In the United Order, individual property rights will be an important component in the economy. Marion G. Romney taught: “As to property, in harmony with Church belief as set forth in the Doctrine and Covenants, no government can exist in peace, except such laws are framed and held inviolate as will secure to each individual the free exercise of conscience, [and] the right and control of property.” (D&C 134:2.) The united order is operated upon the principle of private ownership and individual management. Thus, in both ownership and management of property, the united order preserved to men their God-given agency. In this way, He holds each steward accountable for his own work and productivity. “

The United Order, according to Elder Harold B. Lee, is “more capitalistic … than either Socialism or Communism, in that private ownership and individual responsibility will be maintained” (In Conference Report, Oct. 1941, p. 113.). J. Reuben Clark, Jr. said: “The Church never was, and under existing commandments never will be, a communal society, under the directions thus far given by the Lord. The United Order was not communal nor communistic. It was completely and intensely individualistic, with a consecration of unneeded surpluses for the support of the Church and the poor.” (J. Reuben Clark, Jr., “The United Order and Law of Consecration As Set Out in the Revelations of the Lord,” from a pamphlet of articles reprinted from the Church Section of the Deseret News, 1942, pp. 26–27.)

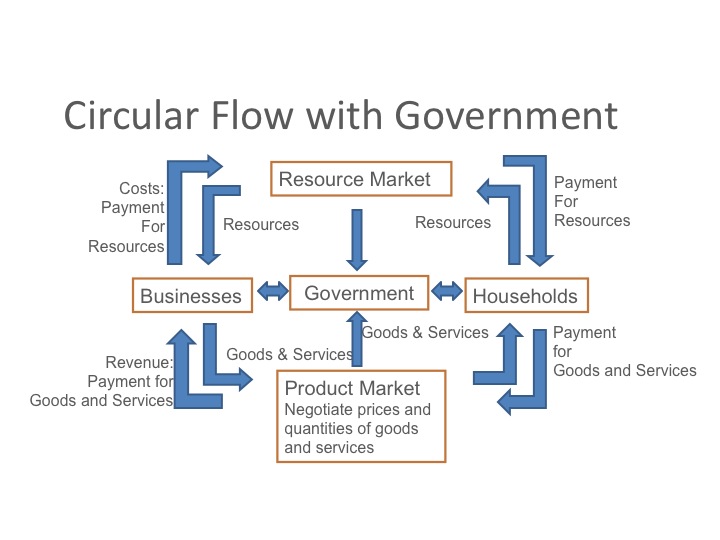

When government becomes a player in the economy, they interact with households and businesses through taxation and transfers. The government also purchases resources from the resource markets as well as goods and services from the product market. As the economy opens trade with other countries, foreign nations demand and supply goods and services in the product market, as well as demand and supply resources in the resource market.

Practice

Think about how the fear of a recession would be reflected in the circular flow diagram. How would consumers react? How would producers react?

Unfortunately, household expectations often become “self-fulfilling prophecies.” If households fear that they may lose their job if a recession occurs, they may start to spend less and save for the “rainy day.” This decrease in the demand for goods and services in turn causes businesses to demand fewer resources, and the job cuts that were expected occur.

Production Possibilities Curve

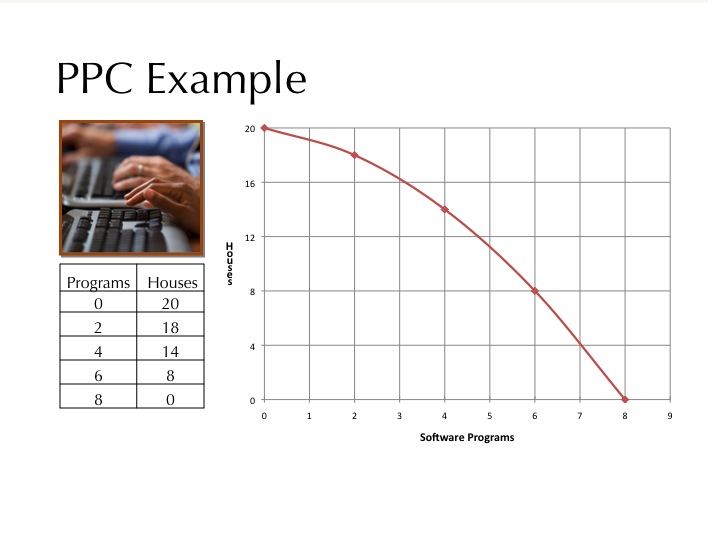

As a society, we produce literally thousands of different goods and services. To better understand the trade-offs faced by an individual or society, we are going to use an economic model called the production possibilities curve (PPC), sometimes referred to as the production possibilities frontier (PPF). Recall that an economic model is a simplification of the real world and is designed to illustrate economic theories. In this case, we will assume that only two different goods or services can be produced. The production possibilities curve shows the maximum combination of these two goods or services that can be produced given our present technology and resources.

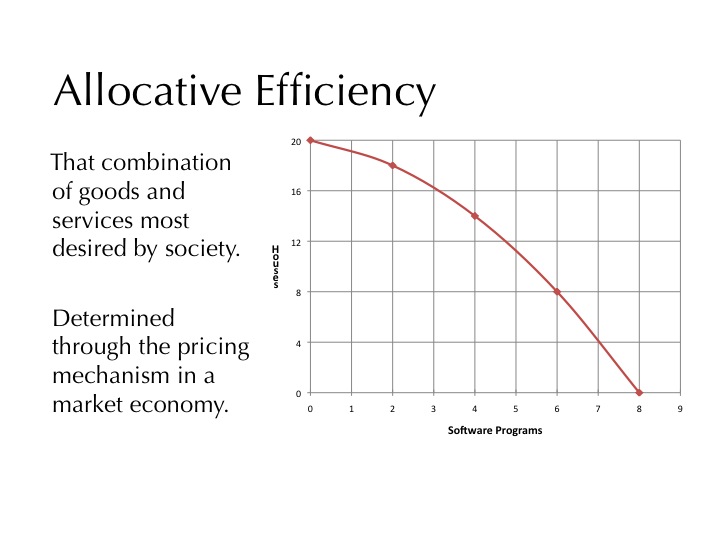

Let’s say that our class represented a country and we were going to produce houses and software programs. Given our current technology and resources, the table below shows the different combinations of houses and software programs that we could produce as a society during the next year using all our resources in an efficient manner. The curve on the graph is the production possibilities curve or frontier which shows the maximum combination of houses and software programs we are capable of producing.

The PPC has a bowed out or concave shape, since some resources are better at producing one item than they are another. A hammer is a great tool for building houses, but has little use in developing a software program. Likewise, those with programming experience may do a great job computer programming, but lack construction skills.

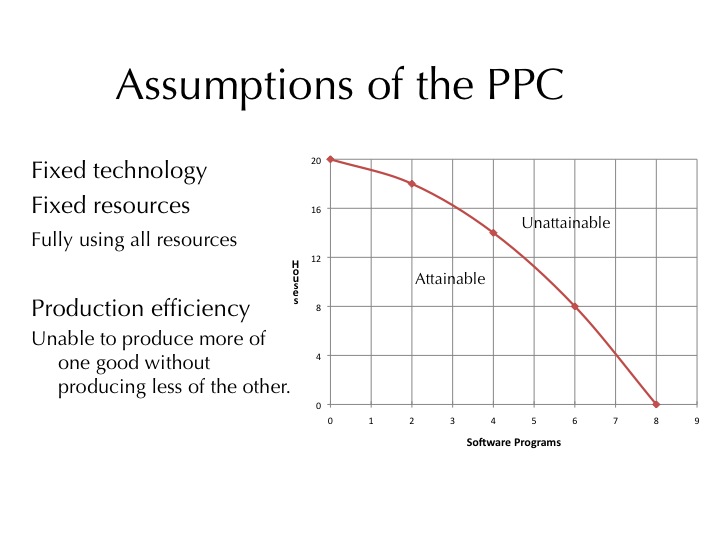

To be on the production possibilities curve, we assume that technology and resources are fixed and that we are using all of our resources. We also assume production efficiency meaning that we are unable to produce more of one output without producing less of the other output. Note that every combination on the line and below the line is attainable while those points outside the line are not attainable, given our current resources and technology. Since we have limited resources, the production possibilities curve reflects scarcity since we are limited on the amount of goods and services that can be produced.

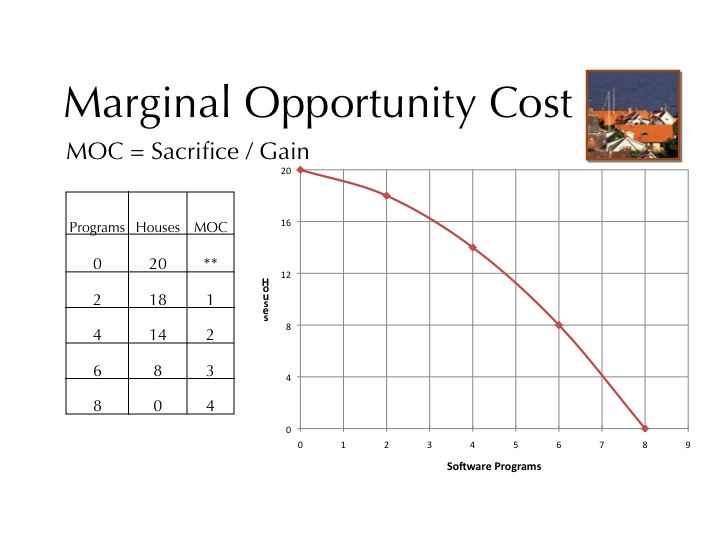

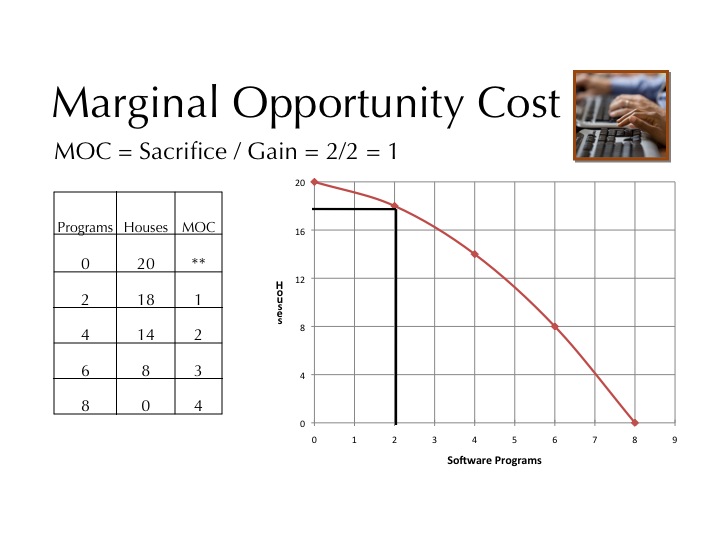

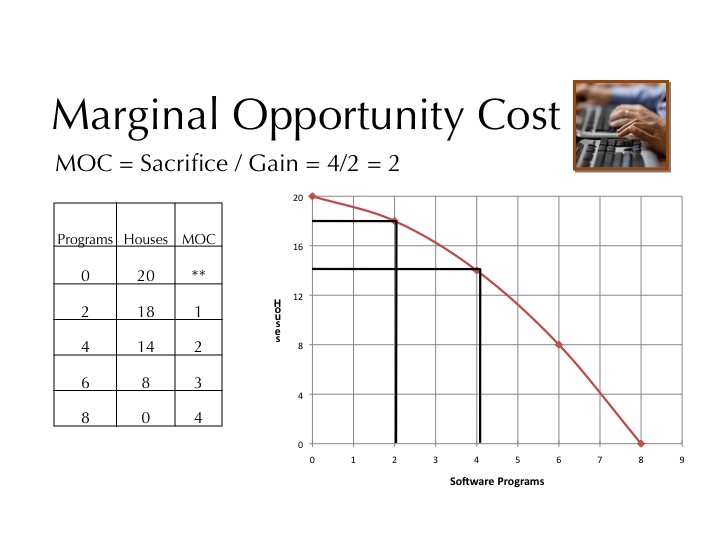

The production possibilities curve also reflects opportunity costs, since to get more of one good we have to sacrifice some of the other. The marginal opportunity cost measures the amount of a good that has to be sacrificed for each additional unit of the other good.

When everyone is working on houses we can produce 20 houses annually. If we wanted 2 computer programs we would have to sacrifice two houses. Thus the marginal opportunity cost would be 1 house for each additional computer program. Who would be the individuals we would want to move from construction to programming? Likely those individuals who are good at programming and not very good at building houses.

If we wanted an additional 2 computer programs, we would have to sacrifice 4 houses or 2 houses for each additional program. Note that the marginal opportunity cost is increasing.

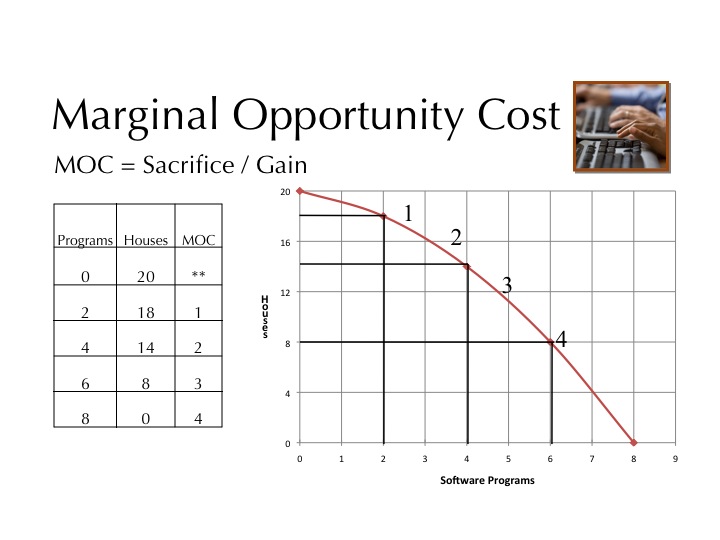

As we want more and more computer programs the number of houses we have to sacrifice per computer program increases. The increasing marginal opportunity cost is due to the fact that some resources are better suited for producing one good than another. Eventually, we have to take experienced construction workers and set them down behind a computer and tell them to start programming.

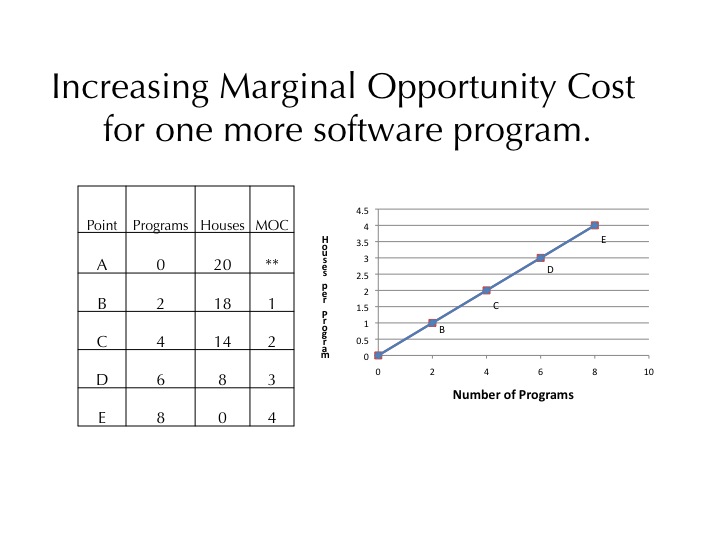

As we move from point A to point B, we sacrifice one house for each additional program. As we want more programs, the marginal opportunity cost increases to 2, then 3, and finally as we move from point D to E, we must sacrifice 4 houses for each additional computer program. Thus we see that we have an increasing marginal opportunity cost as more of the good is produced.

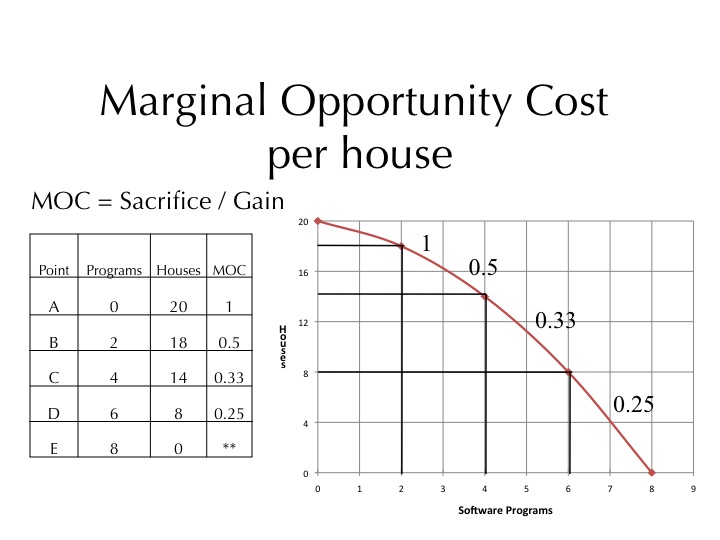

Going the opposite direction, we can compute the marginal opportunity cost for one more house. If we were producing 8 software programs and wanted some housing, we would have to give up 2 computer programs to gain 8 houses, moving from point E to D. Thus a marginal opportunity cost would be one-fourth of a software program per house. As we want more houses, the number of computer programs we would have to sacrifice per house would increase from .25 (E to D) to .33 (D to C), .5 (C to B) and 1 (B to A). For simplicity, we assume that we have to produce at one of the points A through E. Note that as we produce more houses the marginal opportunity costs increases.

While each point on the production possibilities curve is productively efficient, there is only one point that isallocatively efficient - that is the combination of goods and services most desired by society. In a market economy that combination is determined by supply and demand. If no one wants a particular good, the producer will find that he or she is better off using the resources to produce something else. Thus, the pricing mechanism signals to producers what consumers want.

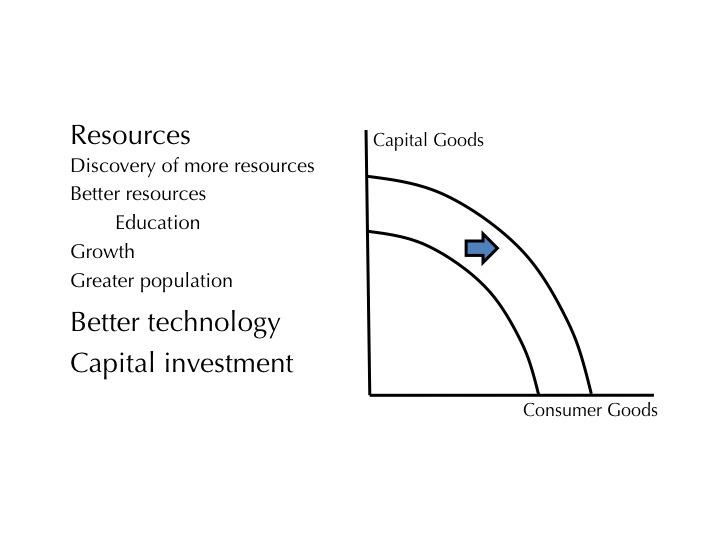

Recall the PPC is based on a fixed set of resources and technology. As new resources are discovered, such as new oil deposits in Wyoming, we are able to produce more as a society. If the quality of the resources improves, we are able to shift the PPC outward. A workforce with a bachelors degree would be more productive than one with only an elementary education. As a society grows, including immigration, there are more workers that are able to produce more goods and services.

Technology also plays a key role in the growth of an economy. As new technologies are developed, resources are freed up to produce other goods and services. A society that produces capital goods (e.g., machinery) today foregoes the benefit of the consumer goods that could have been produced, but is then able to increase the production of goods and services in the future due to the machinery and other improvements that have been made. In 1950, one farmer in the U.S. fed 15 other people. By 1995, that number had increased to 128 and continues to rise. As technology advances and farmers use more and more capital, not as many people are required to be in agriculture and are able to go produce cars, TVs, and other goods and services that we enjoy.

Reference: Agriculture, Technology and the Economy Agriculture, Technology and the Economy

Federal Reserve Bank of Dallas: http://www.dallasfed.org/research/pubs/agtech.html

Federal Reserve Bank of Dallas: http://www.dallasfed.org/research/pubs/agtech.html

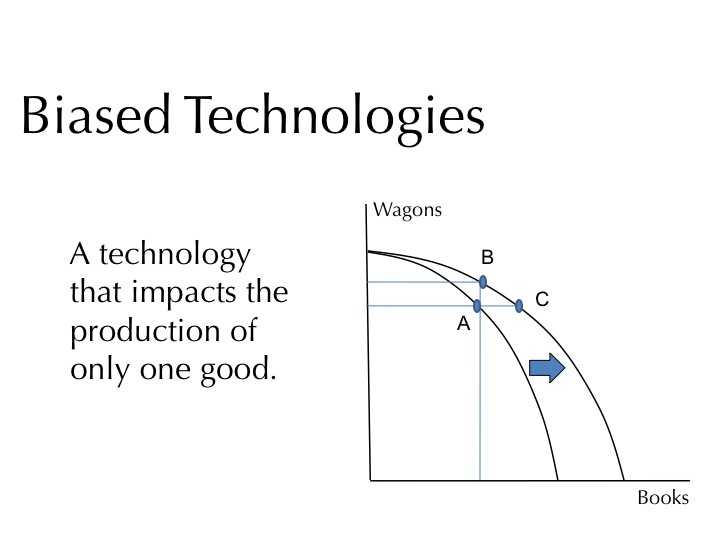

Biased technologies only impact the production of one good. For example, the printing press allowed for more books to be produced, but didn’t increase the number of wagons (if all resources were devoted to wagon production). When both goods are being produced, a biased technology reduces the number of resources being required to produce that good, so more of the resources can be devoted to producing the other good.

Graphically, if the economy is at point A, the invention of the printing press would allow the economy to move to point B, the same number of books with more wagons, or point C, the same number of wagons with more books.

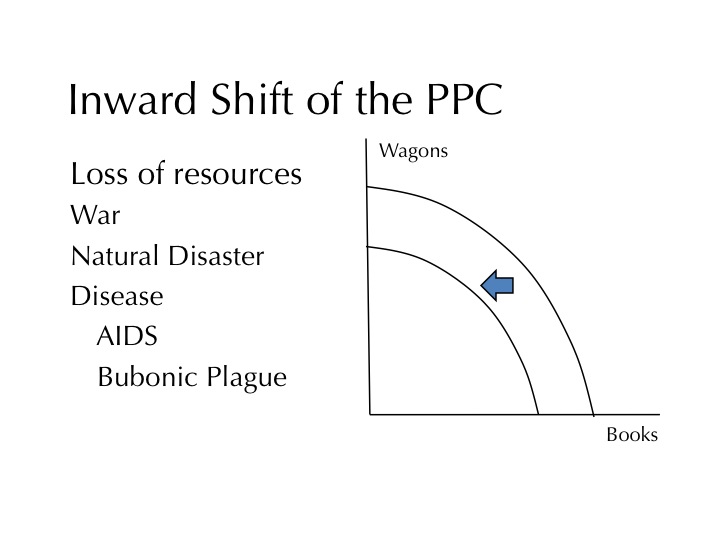

Inward Shift of the Production Possibilities Curve

If a society loses resources, the production possibilities curve would shift in. The loss of resources may come about from war, natural disasters, such as earthquakes or hurricanes, or disease, such as AIDS.

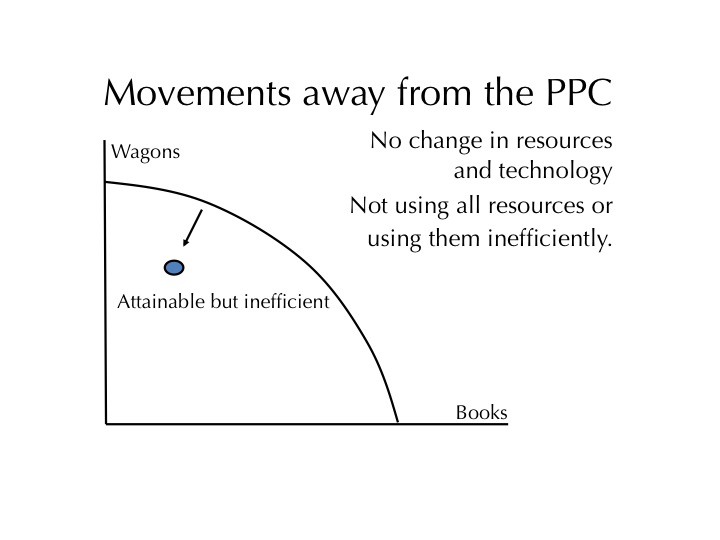

Movements Away from the Production Possibilities Curve

If the resources or technology of a society change, the PPC will shift in or out. However, the PPC does not shift when resources are left unused or when they are not used efficiently. In this latter case, production would simply be illustrated by a point inside the PPC, i.e. society would be moving away from the PPC to an interior point. For example, an increase in the unemployment rate would move a society further inside the PPC. Note that the resources still exist so the PPC has not changed, we are just not using all of resources that we have.

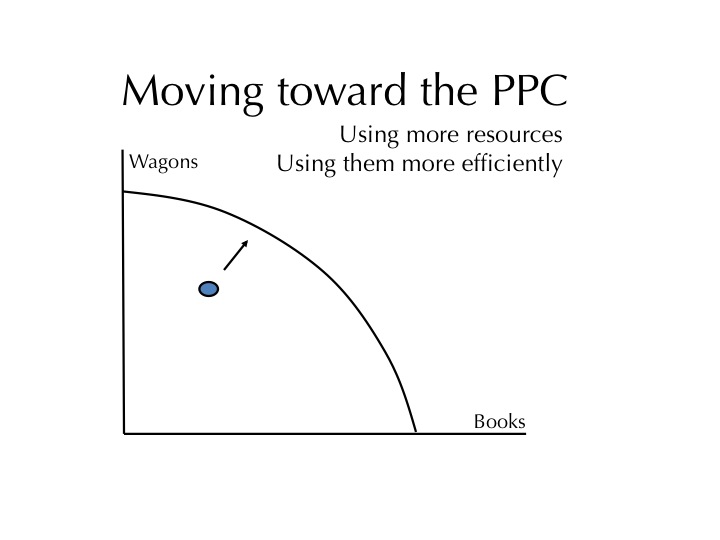

Moving Toward the Production Possibilities Curve

Conversely, if more unused resources are used or the resources are used more efficiently (not due to a change in technology), the society would move toward the PPC.

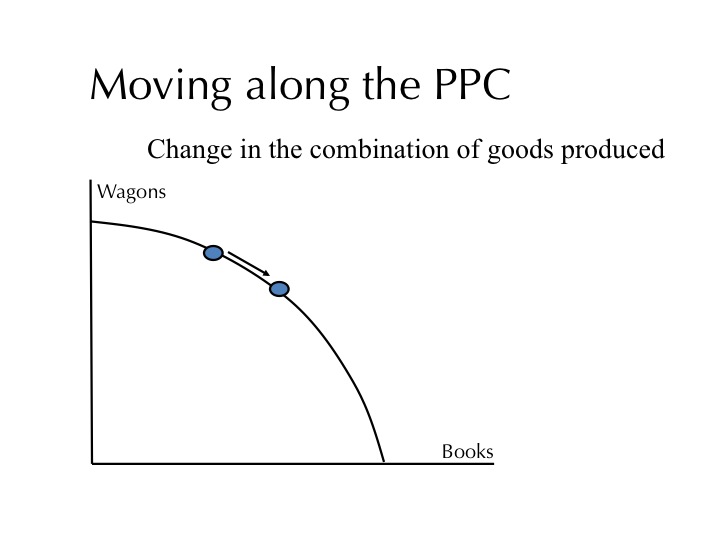

Moving Along the Productions Possibilities Curve

Movement along the PPC occurs when there is a change in the combination of goods and services produced. In a market economy, consumers signal to producers the types of goods and services they require, desire and are willing to pay for.

Practice

Explain how the Production Possibilities Curve reflects scarcity and opportunity cost. Think of personal examples that will move you away from or twoard the Production Possibilities Curve or shift the Production Possibilities Curve (e.g., the 2010 earthquakes in Haiti and Chile).

Absolute Advantage

Adam Smith taught the importance of specialization and trade.

“It is maxim of every prudent master of a family, never to attempt to make at home what will cost him more to make than to buy. The taylor does not attempt to make his own shoes, but buys them of the shoemaker.”-- Adam Smith, 1776

When Adam Smith spoke of the benefits from trade, he was referring to individuals specializing in the production of a good or service for which they had an absolute advantage. An individual or country has an absolute advantage in the production of a good when she/it can produce the good using fewer resources than another. For example, assume on one acre of land Cain can produce 100 lbs of potatoes or 2 lambs (or some linear combination of the two products), and Abel can produce 50 lbs of potatoes or 4 lambs (or some linear combination of the two products). Cain would have an absolute advantage in potatoes and Abel in lambs. In this case, Adam Smith would argue there is a basis for trade that would make them both better off. Let's say without trade the brothers use their land to produce half of each product, i.e. Cain produces 50 lbs of potatoes and 1 lamb; Abel produces 25 lbs of potatoes and 2 lambs. If they specialize then Cain would produce potatoes (100 lbs) and Abel would produce lambs (4). They could then trade say 25 lbs of potatoes for 1 lamb and both would be better off (Cain would then have 75 lbs of potatoes and 1 lamb and Abel would have 25 lbs of potatoes and 3 lambs) - both are better off! But what if an individual or country has an absolute advantage in many things, would there still be benefit to specializing and trading?

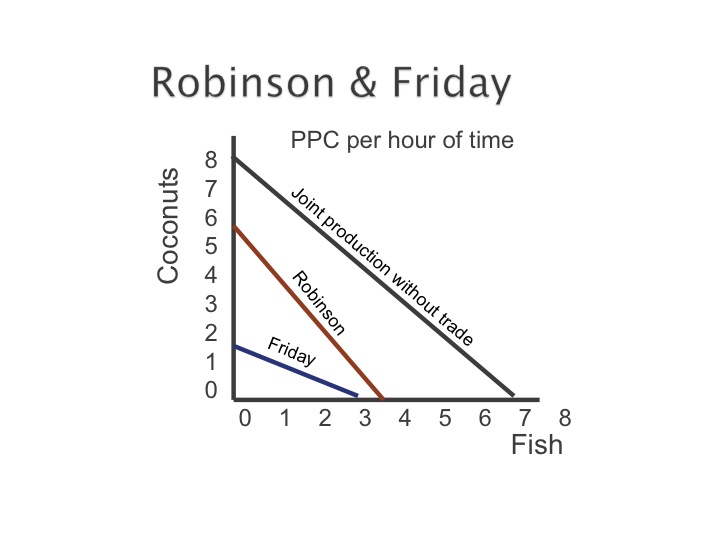

To see if there are advantages to trade, even if one individual has an absolute advantage, let’s use the example of an deserted island with only two individuals: Robinson Crusoe and Friday.

Assume that their diet will consist of fish and coconuts and that Robinson can catch 4 fish per hour or gather 6 coconuts per hour, while Friday can catch 3 fish per hour or gather 2 coconuts per hour. Note the Robinson has an absolute advantage in both fishing and coconut gathering. If each person wants 6 fish and 6 coconuts per day, would there be an advantage in them specializing and trading?

If they don’t specialize, how long will it take each person working alone to meet their daily needs? Robinson would spend an hour and a half fishing and one hour gathering coconuts for a total of 2.5 hours. Friday will spend 2 hours fishing and 3 hours gathering coconuts for a total of 5 hours.

If Robinson spent an hour fishing instead of gathering coconuts, he would have to give up 6 coconuts to get 4 fish, so his marginal opportunity cost per additional fish is (6 divided by 4) or 1.5 coconuts per fish. If instead he spent an hour gathering coconuts, he would give up 4 fish and gain 6 coconuts. Robinson’s marginal opportunity cost per coconut would be (4 divided by 6) or two-thirds of a fish. Friday’s marginal opportunity cost of spending an hour fishing instead of gathering coconuts would be 2 coconuts for 3 fish or two thirds of a coconut per fish. His marginal opportunity cost per additional fish would be 3 fish (divided by 2 coconuts) or 1.5 fish per coconut.

To see if there are advantages to specializing and trading, we now look at the marginal opportunity cost of each. We find that the marginal opportunity cost per additional fish is less for Friday compared to Robinson. Friday gives up only 2/3 of a coconut per additional fish compared to Robinson’s 1.5 coconuts per additional fish. Since Friday has a lower marginal opportunity cost for fishing, he is said to have a comparative advantage in fishing. In comparing the marginal opportunity cost for gathering coconuts, we find that Friday’s is 1.5 fish per coconut while Robinson’s is only 2/3 of a fish per coconut. Thus, Robinson is said to have a comparative advantage in coconut gathering while Friday has a comparative advantage in fishing.

An individual is said to have a comparative advantage if she has relatively lower marginal opportunity costs than another individual. Recall from earlier that marginal opportunity cost is sacrifice divided by gain. Just as individuals have a comparative advantage, countries have comparative advantages based on what resources they possess. Can comparative advantage (having lower opportunity costs) form the basis for mutually beneficial trade? Yes! When specialization takes place according to comparative advantage, the trading individuals (or countries) will both be better off. The concept of comparative advantage was taught by English economist David Ricardo (1772 – 1823) who pointed out that it is comparative advantage that will allow both countries to gain from trade.

Reference: http://eh.net/encyclopedia/article/stead.ricardo

Is it advantageous for Robinson Crusoe to specialize in gathering coconuts, even though he can do both fishing and coconut gathering better than Friday? If they each specialize, what will be the time savings to each?

If Robinson specializes in gathering coconuts and he must now gather 12 coconuts (6 for himself and 6 for Friday), and would need to work 2 hours. Friday specializing in fish would need to spend 4 hours to gather enough fish for himself and Robinson.

Even though he has an absolute advantage, Robinson is able to save half an hour by specializing and trading. Friday is able to save an hour of time by specializing and trading. Even though Friday gains more than Robinson from specializing, each person is better off.

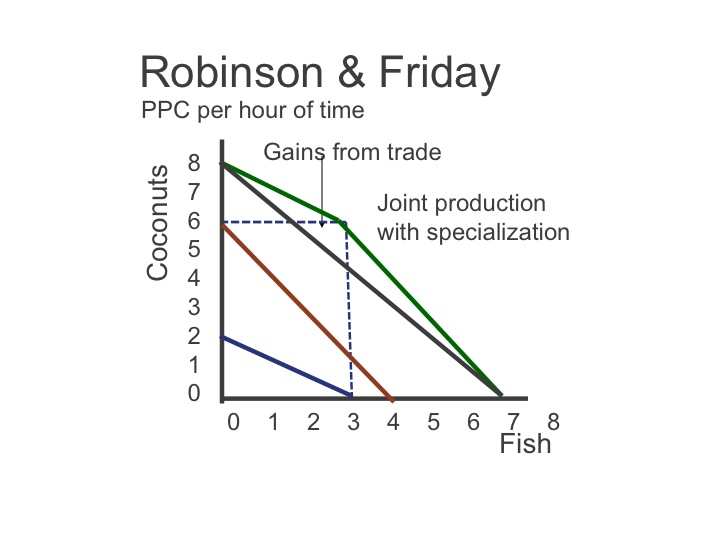

We can represent Robinson Crusoe's and Friday's production abilities using PPCs. Note that because we are assuming that they can switch from fish to coconuts at a constant rate that the PPCs will be linear rather than bowed outward as we saw earlier (i.e. rather than increasing opportunity costs as we saw in the PPCs before, they have constant opportunity costs).

Friday’s output per hour is shown by the PPC closest to the origin. He can gather 3 fish per hour or 2 coconuts per hour. Robinson’s PPC is greater than Fridays since he has an absolute advantage in producing both goods. If they don’t specialize, their joint production without specializing is represented by the PPC furthest from the origin.

Specialization allows the joint PPC to shift out even further. If they only produced fish, they could still only produce 7 fish per hour, and both gathering coconuts would allow them to gather 8 per hour. By Robinson specializing in coconuts and Friday in fish, they could have 3 coconuts and 6 fish by each working an hour. The outward shift shows the gains from specializing and trading.

For trade to take place, each individual must benefit. An individual would not be willing to trade for a good that would cost him more than he or she could make by themselves. Highest and lowest rates at which the goods would trade for are determined by each individual's marginal opportunity cost. In our example, Friday is specializing in fish production and Robinson in gathering coconuts. Since they each want some of both, the terms of trade would have to be acceptable to both. The terms of trade would include the rate at which one good would trade for another. In looking at the marginal opportunity costs, we see that the terms of trade range from 2/3 to 1.5. Friday must receive at least 2/3 of a coconut for each fish he gives up, and Robinson would not be willing to pay more than 1.5 coconuts for each fish he receives. Somewhere between this range, both individuals would benefit. Read the following quote by President James E. Faust, paying special attention to the highlighted sentences.

We live in an age of specialization. When I was a boy, many people had Model T Fords. Compared to modern cars, they were relatively simple mechanically. Many people were able to fix their own cars by grinding the valves, changing the rings on the pistons, putting in new brake bands, and using a generous supply of baling wire. Nowadays automobiles are so sophisticated that the average person knows very little about how to repair them. The mechanics of today use a computer to diagnose engine problems. I mention this example to encourage you young men to get training and education in order to keep up. Technical education is very important, and the same thing is true in fields of higher education. Any kind of skill requires specialized learning.- Pres. Faust – Message to My Grandsons, Sat. Priesthood Session April 2007.

As Adam Smith points out: “What is prudence in the conduct of every private family, can scarce be folly in that of a great kingdom. If a foreign country can supply us with a commodity cheaper than we can make it, better buy it of them with some part of the produce of our own industry, employed in a way in which we have some advantage.”

Since the resources of each country vary, there is a benefit to specializing in a good in which we have a comparative advantage. Although we may have the resources to grow bananas in Idaho, we do not have a comparative advantage in banana production. Thus we specialize in potatoes and other goods and services for which we have a comparative advantage and trade for bananas and other tropical fruits from countries that have a comparative advantage in producing those goods.

Trade can improve the economic well being of the individuals and often the political relations among the different countries. We see examples of this in the scriptures, especially in the Book of Mormon.

And it came to pass that the Lamanites did also go whithersoever they would, whether it were among the Lamanites or among the Nephites; and thus they did have free intercourse one with another, to buy and to sell, and to get gain, according to their desire.And it came to pass that they became exceedingly rich, both the Lamanites and the Nephites … (Helaman 6:8-9)

Practice

Try to answer the following practice questions.

1. Allan and Ryan live on an island. In one day, Allan can catch 10 fish per day or gather 5 coconuts, in the same amount of time, Ryan can catch 8 fish or gather 8 coconuts. Does either one have an absolute advantage in either good?

2. Compute the marginal opportunity cost for each.

3. Determine who has a comparative advantage in each good.

4. Who should specialize in which good?

Since Allan has a lower marginal opportunity cost for fishing compared to Ryan, he has a comparative advantage and should specialize in fishing . Ryan has a comparative advantage in gathering coconuts since he only gives up one fish while Allan must give up 2 fish per coconut.

No comments:

Post a Comment