Section 01: Resource Market

Factors of Production

We now turn our attention to the demand and supply of resources also called inputs or factors.

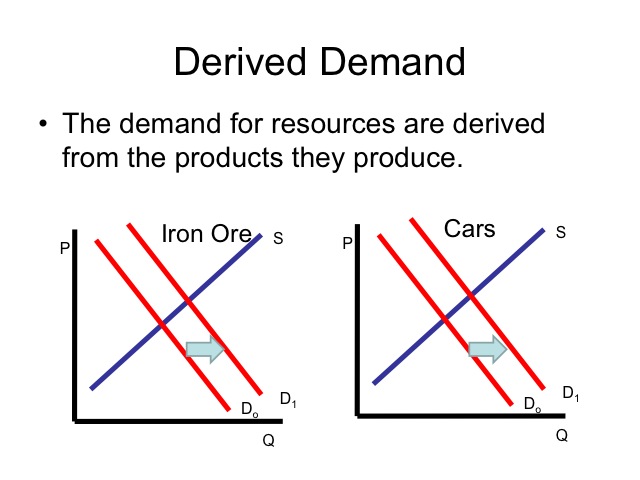

Resources are used in the production of goods and services. The demand for an input or resource is derived from the demand for the good or service that uses the resource. Consumers do not directly value steel, in and of itself, but since we demand cars, we indirectly demand steel. If the demand for cars increases, there would be an increase in the demand for the steel that is used to make cars.

Understanding derived demand and the supply of inputs can help us understand how the markets for inputs function, and in turn, how these markets relate to the markets for final goods (i.e. the goods consumers actually purchase). Understanding these concepts enable us to determine how much a firm would be willing to pay for steel on the margin or if it is worth paying someone $20 per hour. These answers depend on the value or revenue generated by using an additional amount of the input in question (i.e. what is the value or revenue generated by an additional worker) compared to what it costs to employ that additional amount of input (i.e. the wage rate). Similar to the concept of marginal revenue and marginal cost, which measures the additional benefits and costs of producing another unit of output, we use the concept of marginal revenue product and marginal resource cost which measures the additional revenue and additional cost from using one more input.

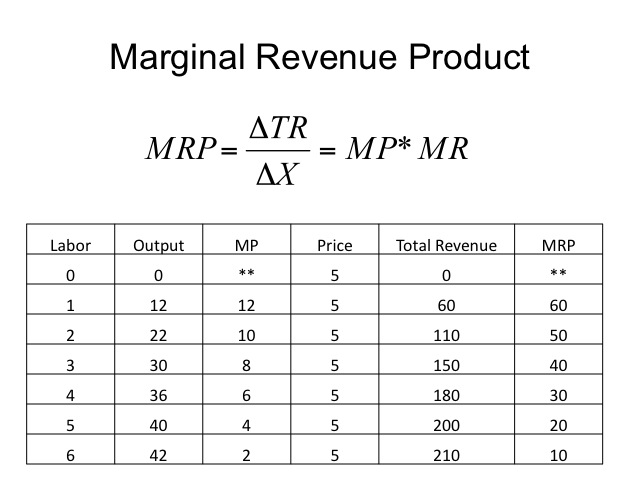

Marginal Revenue Product is the additional revenue generated from using one more unit of the input. Mathematically, it is the change in total revenue divided by the change in the number of inputs (x), which is also equal marginal product times marginal revenue. Let’s simplify this equation so that this outcome is more apparent. Assume that the final good or service is selling in a competitive market, then the marginal revenue is equal to the price of the output. This means TR = Q * P, and in a competitive market, price doesn’t change as output changes, therefore it also won’t change when input levels change. Also recall that Q is the same as total product (TP); the change in TP as the input changes (ΔTP/Δx) equals marginal product, MP (look back to the chapter on production and costs for a quick refresher). So the marginal revenue product is just the change in output that arises from a change in input (i.e. MP) times the price of the output. This tells us something very important, which is, how much this additional input is worth to the firm because of the additional revenue that it generates.

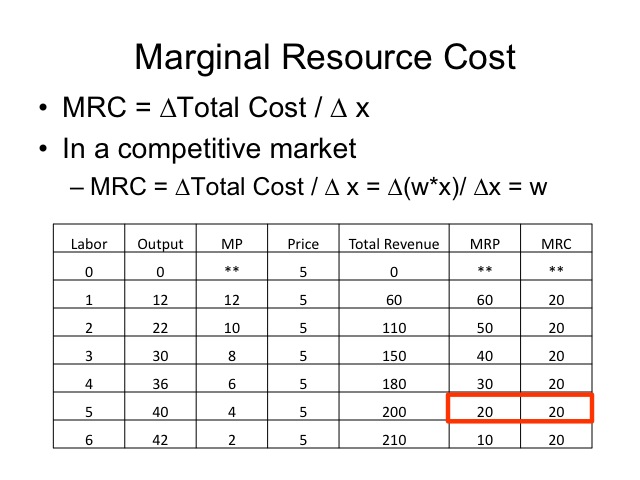

The marginal resource cost is the additional cost incurred by employing one more unit of the input. It is calculated by the change in total cost divided by the change in the number of inputs. In a competitive resource or input market, we assume that the firm is a small employer in the market. In other words, the firm will not be able to affect the price of the input regardless of the number of inputs employed. This is much like a firm in a competitive output market that is too small to affect the price; therefore, it is a price-taker. Under these market conditions, the marginal resource cost is the price of the input, say wages (w), since the additional cost of employing one more unit of the input is just the price of the input.

Now we can return to our earlier question regarding whether it was worth paying someone $20 per hour (assuming the wage was our only variable cost). To answer this question, we would compare the marginal revenue product (MRP) to the marginal resource cost (MRC) of $20. If the MRP is greater than or equal to the MRC then we should employ the resource. If the MRP is less than the MRC, we should employ fewer resources. When examining the marginal revenue product, we see the law of diminishing marginal returns since each additional unit of the input yields a lower marginal product and thus a lower marginal revenue product. This fact highlights an important difference between demand and derived demand; derived demand is downward sloping due to the law of diminishing returns not the income and substitution effects that cause downward sloping demands for consumer goods.

In our example, employing the first unit of labor increases our revenue by $60 and our costs by only $20, so we employ the resource. We continue our evaluation till we get to 5 units of labor where the MRP and MRC are equal. If we were to employ the sixth unit of labor, we would incur an additional cost of $20 but only generate $10 of additional revenue.

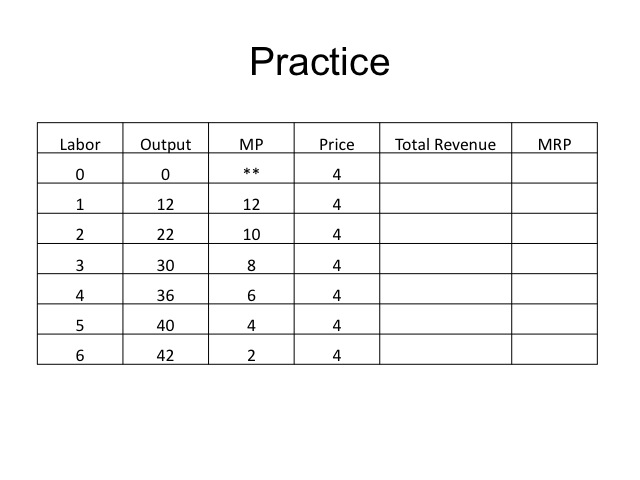

Practice

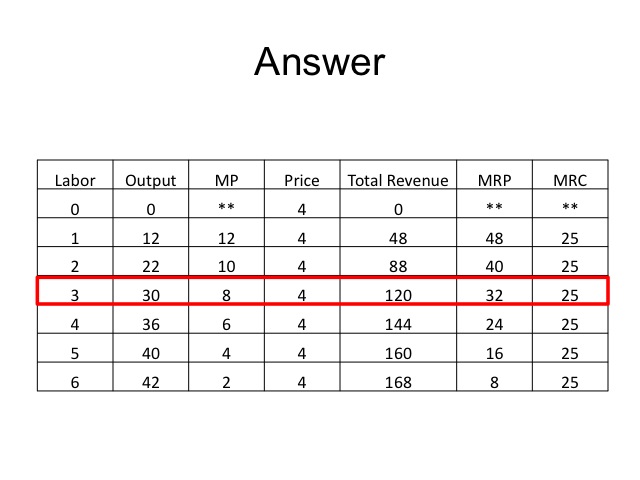

1. If the price of labor is $25, how many units of labor should be employed?

Answer

Comparing the marginal revenue product to the marginal resource cost, we should employ 3 units of labor. In our practice problem, the price of the output is only $4 rather than $5. As a result, the marginal revenue product decreases. In addition to the price of the output changing the marginal revenue product, these other factors will also change the marginal revenue product for labor: human capital – as workers gain additional education or skills that increase their productivity the marginal revenue product; capital – as the amount of capital, such as machinery, available to workers increases, we would anticipate the MRP for labor to increase. Likewise, if workers are able to work with better equipment through increases in technology, the productivity of workers increases.

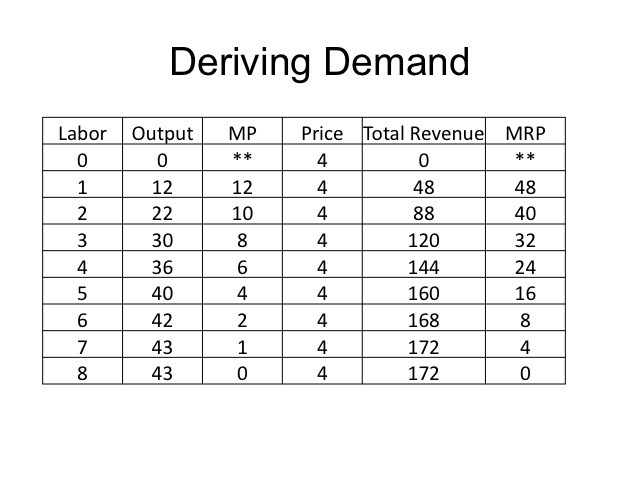

Using our decision rule of MRP = MRC, we can derive the demand curve for an input. Determine the optimal number of inputs to employ given the following prices of the input or wage rate:

$4

$8

$16

$24

$32

$40

$48

$8

$16

$24

$32

$40

$48

From this demand schedule, we can create a demand curve for labor.

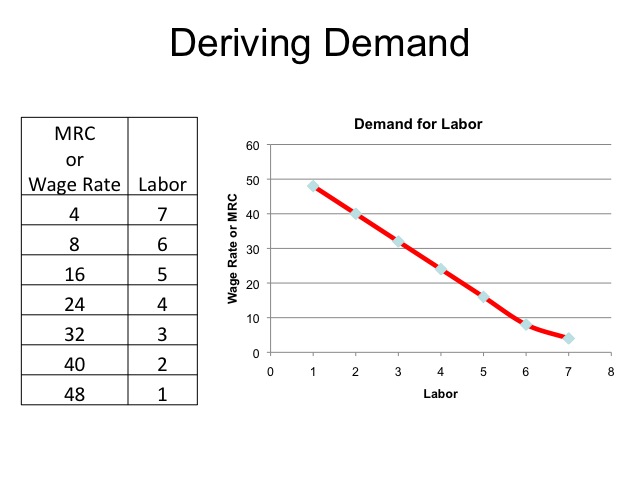

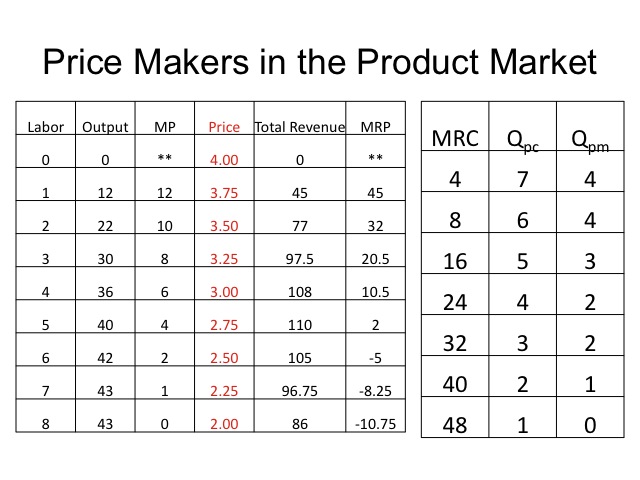

If the firm is a price maker in the product market, price is not equal to marginal revenue. Since marginal revenue is less than price, the demand for the resources will decline faster as the price of the input increases. The table on the right shows the quantity of labor demanded in a perfectly competitive market (pc) where price equals marginal revenue and the quantity of labor demanded when the firm is a price maker in the product market (pm).

In the table on the right, the quantity of labor demanded in a perfectly competitive market is from our previous calculation. To calculate the quantity of labor demanded when the firm is a price marker in the product market (pm), we compare the MRC to the MRP from the table on the left. For example comparing the of MRC of four dollars to the MRP, we find that four units of labor, with an MRP of $10.50, would be optimal. The fifth unit of labor would increase revenue by only two dollars which is less than the additional cost of $4.

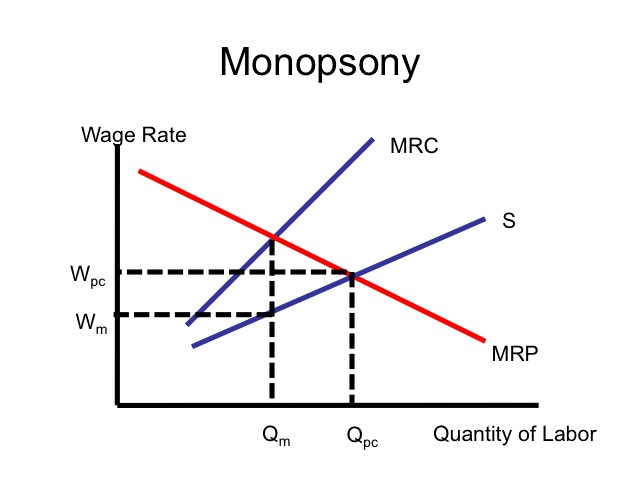

A monopsony exists when there is only one buyer in the market or in the case of the labor market, only one employer. Since the firm is the only buyer, then obviously it will be large enough to affect the wage rate. So the supply curve of labor it faces is upward sloping since at a higher wage rate the quantity of labor supplied increases. This means that it is a wage-setter rather than a wage-taker. How does a monopsony use its market power?

Recall that the marginal resource cost curve is the additional cost incurred by employing one more unit of the resource. When facing an upward sloping supply curve of labor, to employ one more worker, the monopsonist must not only pay a higher wage rate to the next worker, but also pay a higher wage to all the workers it could have hired at a lower wage rate. This causes the marginal resource cost to be to greater than the supply curve. For example, if one worker can be hired at $20 and the second worker can be hired at $25, then the marginal resource cost of hiring the second worker is $30 which includes the $25 paid to the second worker plus the five dollar increase in the wages of the first worker.

The firm will employ a quantity of labor where the marginal revenue product is equal to the marginal resource cost. But the wage rate at that quantity is determined from the supply curve of labor. The monopsonist only has to pay the wage that workers at that quantity level are willing to work for. Compared to the competitive market, we see that the monopsonist will employ fewer workers and pay a lower wage rate.

Recall from consumer behavior, consumers maximize their utility by purchasing those goods or services that give the highest marginal utility per dollar spent. If a consumer could get more marginal utility per dollar from one good than another, they should purchase more of that good and less of the other, increasing their total utility. Thus the decision rule for utility maximization is to purchase that combination of goods such that the ratio of marginal utilities per dollar are the same

(i.e., MU1/P1 = MU2/P2)

(i.e., MU1/P1 = MU2/P2)

This same concept can be applied to the resource market to determine the cost minimizing combination of resources to produce a given level of output. In construction, for example, a certain level of output may be attained by various combinations of labor and capital. A nail gun is able to do the work of several workers with hammers. Other examples: would be using different foods to meet given dietary guidelines, e.g., calories, protein, or carbohydrate level. To reach a certain number of potential customers at the lowest cost, a firm has to decide what combination of media, i.e., radio, TV, newspaper, or the web, allow the firm to reach its goal at the least cost.

To determine the cost minimizing combination of resources to produce a given output level, a firm should select that resource combination that gives that greatest marginal product per dollar. At the point of cost minimization, the ratio of marginal products divided by the resource price (w) will be that same, MP1/w1 = MP2/w2

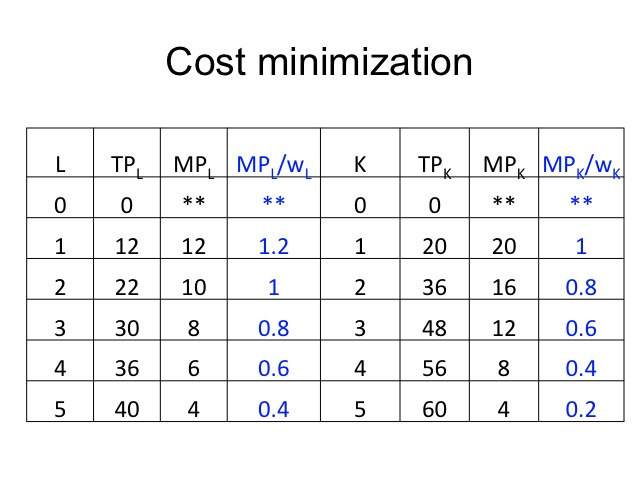

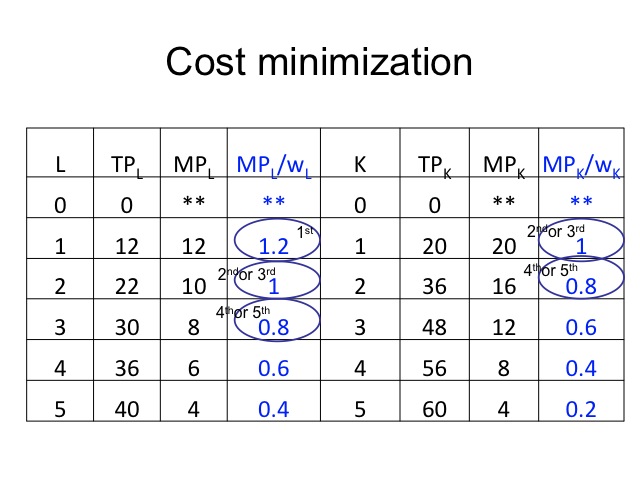

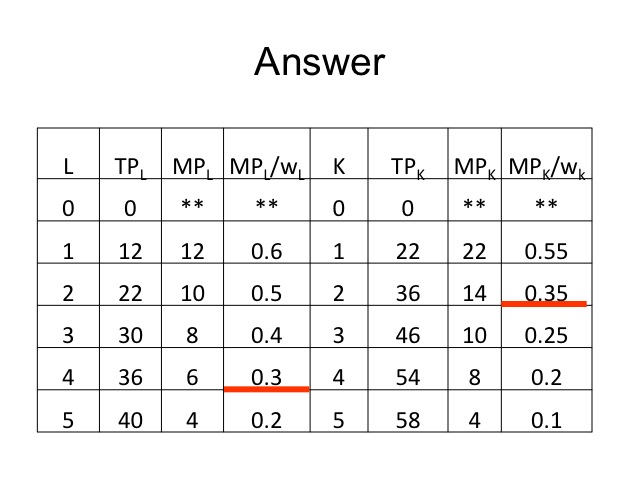

When determining the cost minimizing combination of resources, we must first divide the marginal product of the resources by the resource price. In the above example, the price of labor (L) is $10 per unit and the price of capital (K) is $20 per unit. For simplicity, we will assume that labor and capital are substitutes in production, meaning that there is not a certain amount of labor required to operate the capital.

If we were assigned to produce an output level of 66 units, what combination of labor and capital should we employ?

The first unit of labor gives 1.2 units of output per dollar compared to only 1 unit of output per dollar for capital, so we should use the labor first. Since this would give us only 12 units of output, we need to employ more resources. The second unit of labor and the first unit of capital have the same marginal product per dollar, so we are indifferent to which we employ first and since we need both, we will employ each. Still needing more resources to reach our output level of 66 units, we compare the third unit of labor and the second unit of capital. Both have the same marginal product per dollar and we need both to reach our given output level. Thus we will employ three units of labor and two units of capital to produce 66 units of output.

Practice

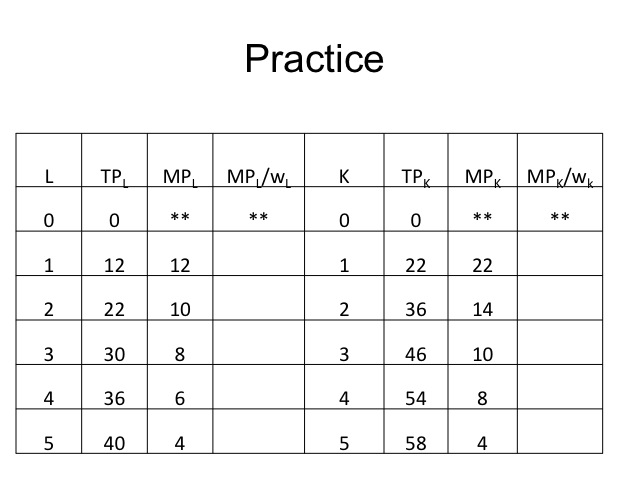

1. Given the price of labor is $20 and the price of capital is $40, determine the cost minimizing combination to produce 72 units of output and the respective total cost.

Answer

The cost minimizing combination would be to employ four units of labor and 2 units of capital.

The total cost is 4*20 + 2*40 = $160.

The total cost is 4*20 + 2*40 = $160.

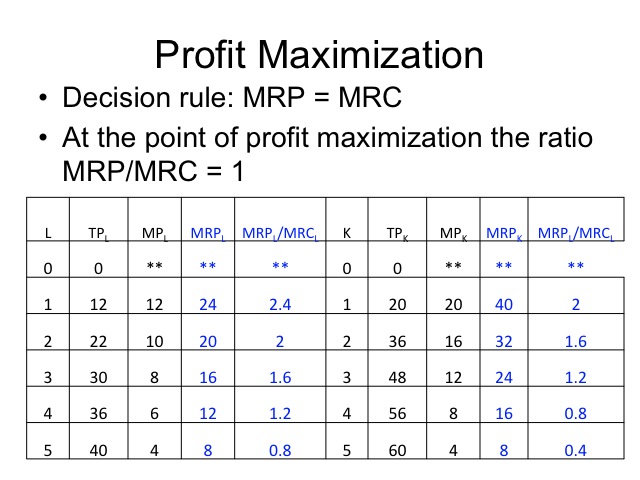

Finding the cost minimization combination of resources to produce a given output level is a necessary but not a sufficient condition for profit maximization. The firm must also determine the output level that maximizes profits. As discussed earlier, a firm must compare the marginal revenue product to the marginal resource cost of using the resource. By dividing the MRP by MRC, we can compare the additional revenue generated per dollar cost of the resource. For example, if the MRP/MRC is $2, then the firm is generating two dollars of revenue for every dollar of cost of the resource.

For example, assume that the price of output is $2 per unit and the price of labor is $10 and the price of capital is $20. To determine the profit maximizing input level, we would first compute the marginal revenue product for each input then divide it by the resource price or marginal resource cost. We then determine which inputs, if employed, would add more additional revenue than cost. In looking at labor, we would employ four units. If we employed the fifth unit, we would only generate 80 cents of revenue per dollar cost. In looking at capital, we would employ three units of capital. If labor and capital were the only costs, we could determine the resulting profit. Using four units of labor and three units of capital, we would produce 84 units of output or $168 of revenue. Subtracting total costs of 4 labor units times $10 plus 3 capital units times $20 = $100, yields a profit of $68.

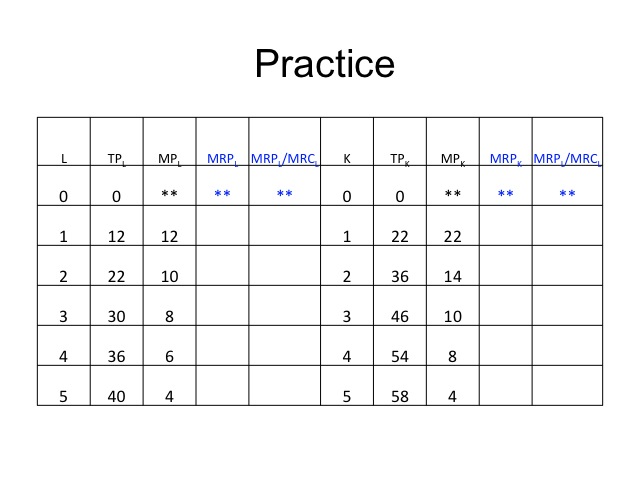

Practice

1. Given an output price of $3 per unit, labor cost of $20 per unit and capital cost of $30 per unit, determine the profit maximizing combination of resources and the respective output level and profit.

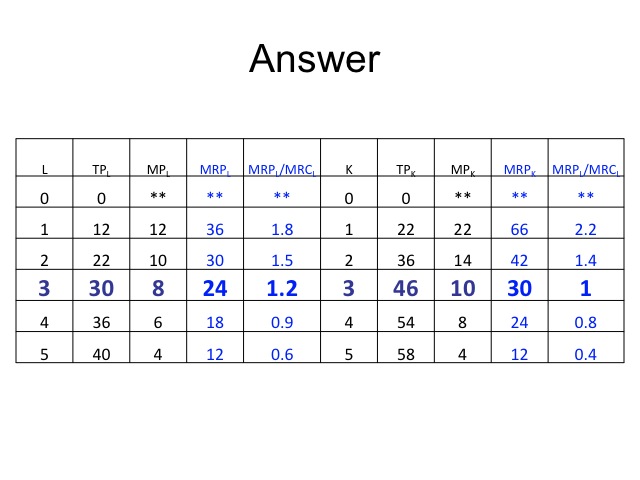

Answer

The profit maximizing combination of resources would be 3 units of labor and 3 units of capital, to produce 76 units of output and a profit of: ($3 x 76) – ($20 x 3) – ($30 x 3) = $78.

There is another interesting feature about resource markets that is specific to labor. This feature arises because, unlike other inputs, workers are utility maximizers and they experience a trade-off between work and leisure. This interesting trade-off may result in an unusual supply curve for labor which exhibits a backward bending segment at higher wage rates. The backward bending nature arises because it is possible when wages get high enough that the quantity supplied of labor declines with further wage increases. In general, this can be explained quite easily using substitution and income effects (much like they were used for consumer choice and demand).

The worker faces a trade-off between labor and leisure. As the price of labor increases, the substitution effect leads the individual to supply more labor and have less leisure since the opportunity cost of leisure has increased. However, as the wage rate rises, individuals are able to have the same income level with fewer hours of work, allowing for more leisure time. The income effect is often negative and if the income effect is greater than the substitution effect, the individual will reduce the quantity of labor supplied as the wage rate rises. In other words, a doctor or someone making a high wage rate may ask: “What is the value of having more income if I don’t have time to enjoy it?” Thus they choose to work only three days a week and spend the remaining time in leisure activities such as golfing or sailing.

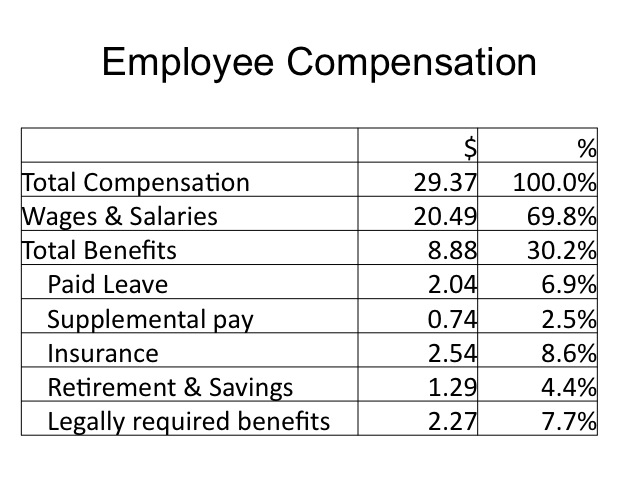

It is important to keep in mind that the wage rate is typically only a portion of the compensation to employees and that workers should consider the entire package when evaluating employment alternatives. According to the Bureau of Labor Statistics, total benefits make up 30.2 percent of the total compensation to civilian workers.

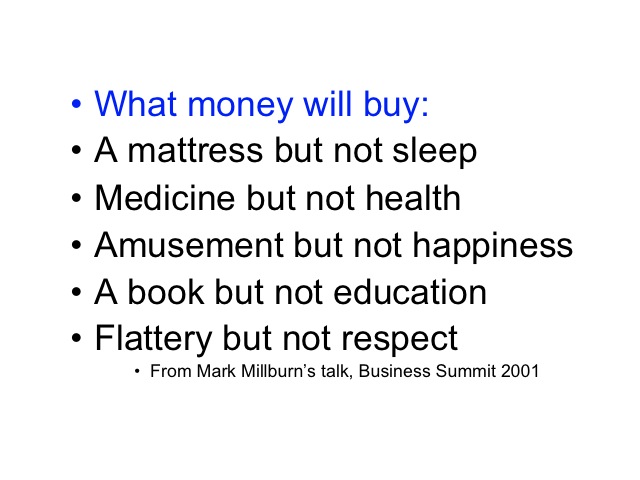

Think of what you would like to have in a career. While monetary reward is important, there are many other factors that individuals seek for in their employment, particularly when they consider the portion of their life that will be spent working. Many of these factors are non-pecuniary or non-monetary but still are important factors of a career. Since individual preferences vary, the factors that individuals seek for in a career will also vary. These factors may include: a sense of accomplishment, flexibility, opportunities for personal growth or advancement, a career that is challenging, the location where one lives, the people that one would work with, or the lifestyle that can be lead, such as time to be with family or serve in the Church or community. As Mark Millburn pointed out in the 2001 Business Summit, there are some things money can and cannot buy.

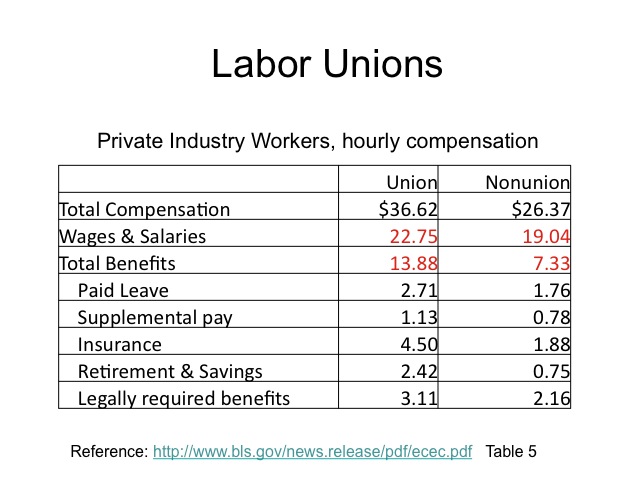

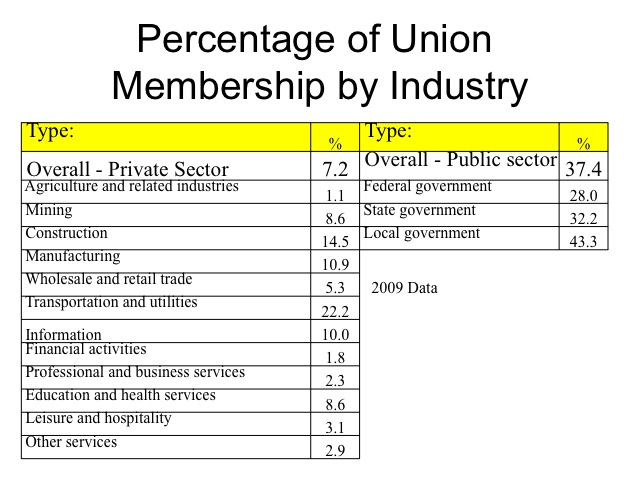

In some labor markets, workers have joined together and formed a labor union. By bargaining collectively with the employers, unions seek to exercise their market power and demand higher wages, better working conditions, or other benefits. Based on the Bureau of Labor Statistics data, while wages and salaries are slightly higher for union workers, benefits are significantly greater for union workers.

Unions may seek to increase the wages of their members either by increasing the demand for labor or decreasing the supply of labor. To increase the demand for labor, unions may pursue a variety of activities.

1. Unions may seek to increase the price of alternative resources, such as lobbying to increase the minimum wage for nonunion workers or restrict the use of capital, which is a substitute to union labor. In 2002, the International Longshore and Warehouse Union (ILWU) shut down 29 west coast ports in part to protest and limit the adoption of technology for loading and unloading. Although it would increase the productivity of workers using the loading and unloading technology, the substitution to more capital, would have reduced the number of workers needed.

Watch: http://www.pbs.org/newshour/bb/economy/july-dec02/ports_10-03.html

Watch: http://www.pbs.org/newshour/bb/economy/july-dec02/ports_10-03.html

2. Unions may increase the productivity of workers through training or apprenticeship programs. As productivity increases, the marginal revenue product would rise increasing the demand for the labor.

3. Unions may pay for product advertisement to increase the demand for product and thus the demand for labor.

4. Last, unions may pursue political activities that increase the demand for the labor such as a requirement to employ only union workers on certain projects.

Alternatively, unions seek to restrict the supply of labor to increase wages by lobbying for laws that restrict that age a person is eligible to work or the number of hours they are allowed to work. For example, the “law says that pilots who work for an airline cannot fly more than 100 hours a month or more than 1,000 hours a year” (http://www.bls.gov/k12/science03.htm). Air traffic controllers have a mandatory retirement age of 56 (http://www.bls.gov/oco/ocos108.htm). Other laws such as licensing requirements restricts the number of entrants in a particular occupation, such as electricians or plumbers. In the early twentieth century, some unions restricted the supply of labor in their crafts by prohibiting African Americans from becoming union members or requiring a literacy test to reduce the number of individuals qualified to join the union.

Reference:

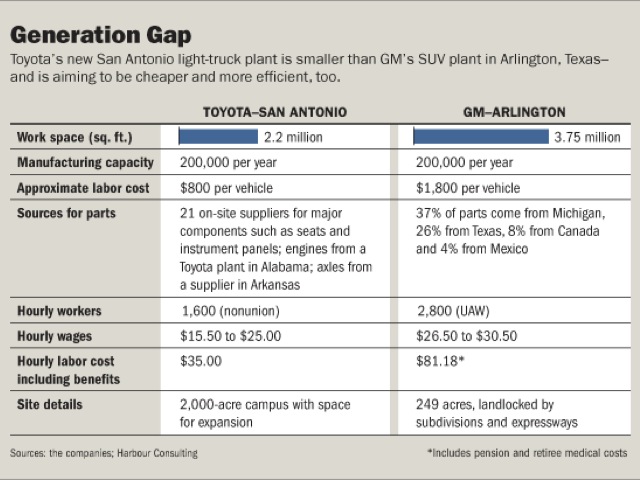

While higher wages and benefit packages help the workers, they increase the cost of making the product as seen in the above comparison of union verses nonunion workers.

With the passage of laws, such as the National Labor Relations Act of 1935 or Wagner Act, union membership increased dramatically in the United States as employers were forced to accept unions if the majority of workers in the company voted for a union. By 1945, union membership peaked at 35 percent of wage and salary workers, but has since declined. In 1947, the Taft-Hartley Act outlawed “closed shops,” which forced firms to hire only union members and allowed states to pass right-to-work laws limiting “union shops, ” which forced workers to join within a certain time period after being hired. Today, the public sector constitutes those industries with the highest percentage of unions members (http://www.bls.gov/webapps/legacy/cpslutab3.htm).

Although unions have negotiated to raise the wages of all union members collectively and improve overall working conditions, some argue that need for unions has decreased due to laws that improve working conditions in the United States, some of which were encouraged by the unions. Another argument that has been made against unions is known as the principal-agent problem, wherein the goals or objectives of the union which represents the workers as a whole conflict with the goals of the individual union member. The individual workers may disagree with how their union dues are being spent or the activities that are supported.

References:

http://findarticles.com/p/articles/mi_m1154/is_v73/ai_3706491/

What would happen if a monopolist (a single seller) met a monopsonist (a single buyer)? Following the closure of a Wal-Mart store in Quebec, just as the first union contract neared completion, several other Wal-Mart stores contemplating unionization voted down the union.

Read the following web pages:

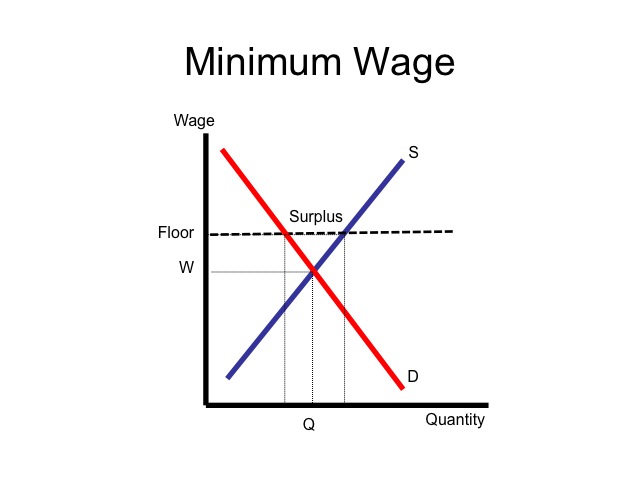

Earlier in the semester we discussed government imposition of price floors, for example minimum wage. When the wage rate is raised above the market equilibrium quantity, there is a surplus of labor, meaning more individuals are willing to work at minimum wage than firms are willing to hire. Increasing the minimum wage results in firms laying off those workers whose marginal revenue product is less than the marginal resource cost.

Some firms will pay a wage rate greater than the going market wage rate. This efficiency wage is intended to discourage workers from shirking at work, increase employee morale and productivity, reduce employee turnover, and increase the pool of qualified job candidates. Paying a wage rate above the market wage may achieve these purposes because it increases the opportunity cost of quitting or getting fired. Since hiring and firing employees can be costly to the firm, paying an efficiency wage may actually reduce labor costs. In part to reduce employee turnover, Henry Ford, in 1914, paid his workers above average wages of five dollars per day. Research indicates that this lead to a greater pool of job applicants, and higher productivity of workers which resulted in greater company profits (http://ideas.repec.org/a/ucp/jlabec/v5y1987i4ps57-86.html).

Another incentive to increase productivity is piece-rate pay, where employees are paid based on what they produce. The advantage of this system is that workers with a higher marginal revenue product are rewarded for their production, which provides an incentive for them to work hard. Sales positions or jobs picking fruit, for example, are often commission or piece-rate based. Some of the challenges that exist with the piece-rate system include accurately measuring the contribution of an individual. If a job requires several individuals to produce a product, it may be difficult to separate the contribution of each. In this case, firms will sometimes employ a group piece rate where the group as a whole is paid for their production. Another potential challenge of the piece-rate system is the impact on quality. Individuals may have a greater incentive to cut corners, resulting in lower quality if they are paid solely based on the number of units produced. If laborers picking fruit, say strawberries or raspberries, are paid by the flat or by the pound, they may have an incentive to pick some berries that are not yet ripe or to pass by ripe fruit that is harder to reach. Social pressure may help or hinder the piece rate system. Competition can encourage other workers to work harder. However, if one worker’s output is far exceeding the others in the group, the group may put pressure on the individual to slow down since she is making the rest of them “look bad.” If the worker desires to be accepted in the group, they may slow down to a “socially acceptable” level of output. Many employers will use some combination of wages and commissions or piece-rate, such that employees are guaranteed some minimum income level yet still provided an incentive to work hard.

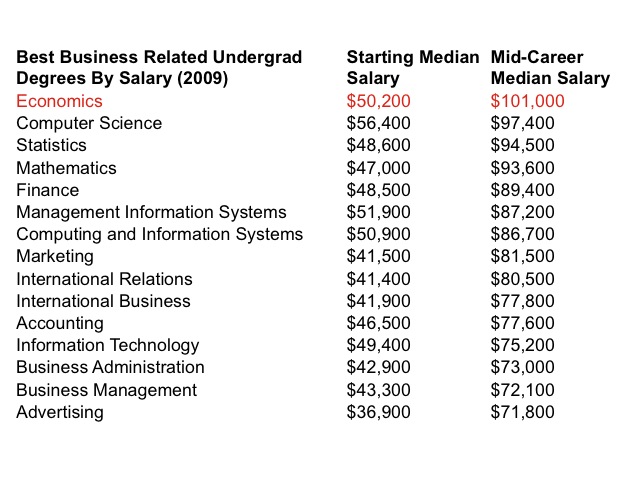

Financially, a career in economics can also be rewarding, since majoring in economics helps students develop strong analytical and quantitative reasoning skills that enable them to not only solve problems but also identify the appropriate questions to ask in evaluating the alternatives that exist. This economic way of thinking helps individuals on a daily basis with the decisions they face and allows them to address issues in a wide variety of areas including finance, business, public policy, and international trade. The table below outlines the salaries of selected business related majors.

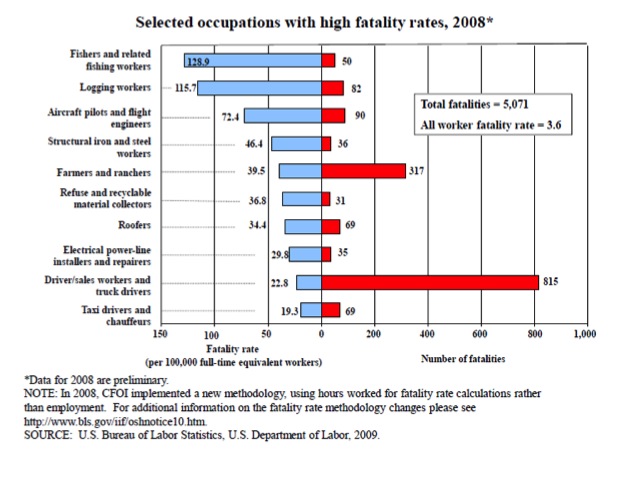

A compensating differential may be required to compensate individuals in occupations that are relatively more unpleasant or risky.

Reference: http://www.bls.gov/news.release/pdf/cfoi.pdf

President Gordon B. Hinckley understood the importance of preparing for a career and that society rewards individuals according to their worth as society perceives that worth.

“Get all the education you can. I repeat, I do not care what you want to be as long as it is honorable. A car mechanic, a brick layer, a plumber, an electrician, a doctor, a lawyer, a merchant, but not a thief. But whatever you are, take the opportunity to train for it and make the best of that opportunity. Society will reward you according to your worth as it perceives that worth." (Gordon B. Hinckley, Teachings of Gordon B. Hinckley, 172–173)

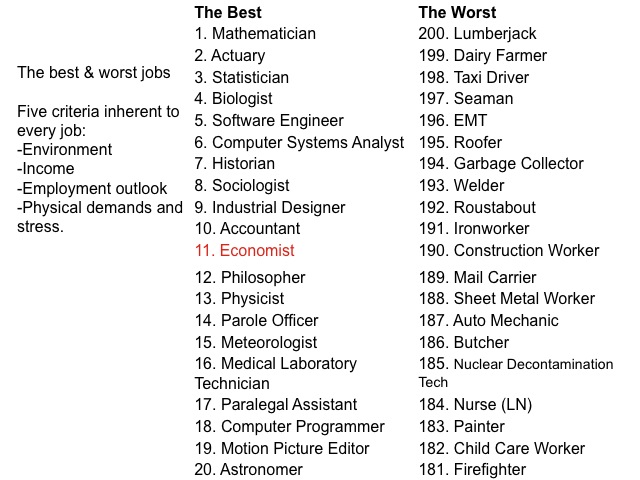

In a market system, wages reflect the equilibrium of the supply and demand for labor. Thus we would anticipate that wage rates would differ based on the occupation. Some occupations require significant training which would limit the supply of the labor in that field. Other occupations may not require substantial training , but the nature of the work or the working environment discourages many individuals from entering that occupation. Based on a study released by CareerCast.com using five criteria, the best and worst of 200 jobs are shown below.

Note that economists ranked eleventh in the study.

At a BYU-Idaho stake conference, Elder Claudio Costa of the Seventy told the students that it used to be as long as you worked hard enough and long enough, you could provide for your family. Today, you can’t work hard enough to provide for a family, you need an education. He then followed up with this important question: Can you find meaningful employment with the major you have chosen? (BYU-Idaho Third Stake Conference, Mar. 10, 2001) Note that meaningful employment is not solely measured by the wage rate, nor does it necessarily require a university degree. Many individuals are able to find meaningful employment with technical training that prepares them to enter a given vocation.

Median earnings differ based on level of education attained. Part of this reflects the human capital or skills attained by completing an education. Another component is that individuals who complete an education are, as a whole, more persistent and diligent and thus tend to earn higher incomes due to their drive and work ethic and not just their level of education. Screening is when firms try to select the best workers from the pool of job applicants. They may choose to consider only those individuals that have completed a certain education level, maintained a certain grade point average, or that have a specified level of work experience.

Practice

As you consider your career, it is important to identify those areas in which you will differentiate yourself from others. With some majors having over a thousand students, each taking similar classes, how will you stand out? Take a few minutes and think of ways that you have or can differentiate yourself from others in each of the following categories:

1. Major / knowledge

2. Skills

3. Values

4. Experiences

Think of what skills are transferrable and applicable and how you can add value to an employer.

To develop these skills or characteristics often requires substantial sacrifice. President Hinckley said: “Now is the great day of preparation for each of you. If it means sacrifice, then sacrifice. That sacrifice will become the best investment you have ever made, for you will reap returns from it all the days of your lives" (Gordon B. Hinckley, Teachings of Gordon B. Hinckley, 172–173).

In the movie "A League of their Own“ in response to Dottie saying she's quitting the team because "it just got too hard, “ Jimmy Dugan (Actor Tom Hanks) responded: “It's supposed to be hard. If it wasn't hard, everyone would do it. The hard is what makes it great.” Those individuals who take the path of least resistance in the educational process, are often rewarded accordingly. Elder Neal A. Maxwell taught:

“When the time comes, young men, make your career choices. Know that whether one is a neurosurgeon, forest ranger, mechanic, farmer, or teacher is a matter of preference not of principle. While those career choices are clearly very important, these do not mark your real career path. Instead, brethren, you are sojourning sons of God who have been invited to take the path that leads home. There, morticians will find theirs is not the only occupation to become obsolete. But the capacity to work and work wisely will never become obsolete. And neither will the ability to learn. Meanwhile, my young brethren, I have not seen any perspiration-free shortcuts to the celestial kingdom; there is no easy escalator to take us there.” (Neal A. Maxwell, “Put Your Shoulder to the Wheel,” Ensign, May 1998, 37)

No comments:

Post a Comment