ECON 110 The Money Market - Answers

St. Charles Community College

Econ 110 Principles of Macroeconomics

Answers to Class Discussion Problem

Econ 110 Principles of Macroeconomics

Answers to Class Discussion Problem

Illustrate the following situations using supply and demand curves for money:

a. The Fed temporarily reduces the discount rate during a national crisis.

Answer: By temporarily reducing the discount rate, the Fed makes it easier for banks to borrow money to cover their reserves. This will increase the money supply and move the money supply curve to the right. Since we don’t know anything about the “national crisis” we can’t say how the money demand curve demand might move.

Note: This is one of the actions taken by the Fed on 9/11/01 when the airplanes flew into the World Trade Center. The Bank of New York had its operations center in the World Trade Center, and the Fed came to its rescue.

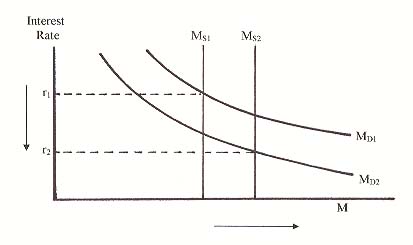

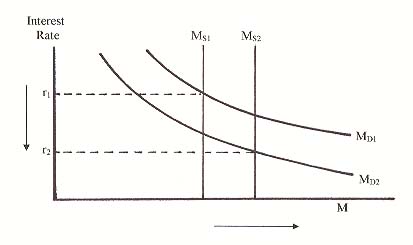

b. The Fed acts to hold interest rates constant during a period of inflation.

Answer: During periods of inflation, when prices are rising and goods and services cost more, consumers and firms generally elect to hold higher money balances to cover the higher costs of transactions This means that the demand for money increases, and the money demand curve shifts to the right. If the Fed elects to hold interest rates constant as the problem states, the Fed will take action to increase the money supply as required. This means that the money supply curve will shift to the right until the interest rate is at its original level.

c. The Fed decreases the reserve ratio during a period of negative GDP growth.

Answer: In general terms, when the economy is not as healthy as it had been previously, consumers and firms become more cost conscious and tend to rein in their spending due to uncertainty. This means that the demand for money balances will decrease, and the money demand curve will shift to the left.

If the Fed elects to decrease the reserve ratio, commercial banks are free to lend a higher percentage of their loanable reserves which will expand the money supply. The money supply curve then shifts to the right.

d. The Fed buys bonds in the open market during a period of slow economic growth.

Answer: This is the most common technique used by the Fed to spur the economy during periods of slow economic growth. When the Fed buys bonds, it puts more money into circulations through the banking system and the money multiplier. The money supply curve will shift to the right.

The money demand curve movement can get complicated. If firms and consumers perceive the slow economic growth as an increase in economic growth, just at a slower rate, the demand for money will increase and the money demand curve will shift to the right as shown below.

However, if firms and consumers perceive the slow economic growth as a mild recession, they may become pessimistic and reduce their demand for money balances. In that case the money demand curve could shift to the left.

e. The Fed sells bonds in the open market during a period of rapidly increasing government spending.

Answer: When the Fed sells bonds, money is taken out of circulation and the money supply decreases. Periods of rapidly increasing government spending means that the economy will grow, possibly introducing some amount of inflation. With prices increasing, households and firms will need to hold cash balances for transactions and the demand for money will increase. The money demand curve will shift to the right.

f. The Fed sells bonds in the open market during a recession.

Answer: Again, firms and consumers tend to be hesitant in their spending during uncertain times. Money demand tends to fall, causing the money demand curve to shift tot the left. When the Fed sells bonds money is taken out of circulation, and the money supply curve shifts to the left. This action by the Fed can compound the recessionary problem in the economy, and that’s exactly what happened in this country and in Europe during the great depression of the 1930’s.

The affect on interest rates in this case is uncertain. It is entirely possible that the two activities could cancel each other in such a manner that interest rates will be affected.

g. The Fed buys bonds in the open market during a period of high consumer optimism.

Answer: When the Fed buys bonds, money is put into circulation. The money supply increases, and the money supply curve shifts to the right. When consumers are optimistic, they spend. At such times those consumers need more money for transactions, and the money demand curve shifts to the right also.

h. A large number of consumers begin using debit cards and ATM machines.

Answer: When technology is introduced into the banking system to the convenience of consumers, the demand for money decreases. The money demand curve shifts to the left. Think of it this way. You can go to the mall with no cash. If you see goods or services that you wish to purchase you can go to the nearest ATM machine or reach for your debit card in your wallet or purse. The problem does not say that there is any action on the part of the Fed, so we’ll assume that the Fed takes no action.

i. The Fed sells securities in the open market during a period of high inflation.

Answer: This situation could very similar to question “e” except that we now have inflation for certain. During periods of inflation, firms and consumers increase their demand for money because prices are higher. The money demand curve shifts to the right. When the Fed sells bonds, it takes money out of circulation, and the money supply curve shifts to the left.

j. Commercial banks raise their loan requirements during a downturn in the economy.

Answer: Commercial banks commonly protect themselves during bad times by scrutinizing the loan applicants very carefully. They want to protect themselves against bad loans. They raise their loan requirements for households and for firms. Fewer loans mean less money in circulation which means that the money supply curve shifts to the left. On the demand side, firms and consumers tend to be more conservative in their spending during recessions, so the money demand curve shifts to the left also.

Hey Nice to meet you :)

ReplyDeleteMau nawarin aja nih kesempatan menang jutaan rupiah hubungi aku ya :)

klik di bawah ini, click below :

Chat Me Here

Chat Aku Disni ya

Agen Slot Online Terbaik

ReplyDeleteAgen Online Terbaik

Panduan Judi Onlie

Nonton Movie

Agen Casino Terpercaya

ReplyDeletehttps://bit.ly/2ENk1VF

HOBI BOLA,KASINO, POKER !!!

Dengan Berbagai Promo Menarik lain, Penasaran?? AYO JOIN SEKARANG!!!!

Yuk Gabung Bersama Kami Sekarang Dengan Berbagai Macam Bonus Menarik Seperti:

-Bonus new member 180%

-Bonus Member 30 %

-Bonus 5% setiap hari

-Bonus New Member POPker 20%

Info Lebih Lanjut Bisa Hub kami Di :

WA : 081358840484

BBM : 88CSNMANTAP

Facebook : 88CSN

-www.wes88.com

Situs Judi Slot

ReplyDeleteBerita Seputar Indonesia

Artikel Tentang Slot

Judi Slot Terbaik

Agen Slot Terbaik

Agen Poker Terbaik<

festivalfling.com

ReplyDeleteMBO128 Adalah Situs Judi Online Taruhan Sepak Bola, Casino, Sabung Ayam, Tangkas, Togel , Poker Terpopuler di Indonesia. Pasang Taruhan Online Melalui Agen Judi Terpercaya Indonesia MBO128, Proses Cepat, Banyak Bonus, Online 24 Jam dan Pasti Bayar!

ReplyDelete1 Userid bisa bermain semua permainan

Sabung Ayam

Sbobet

Casino Online

Tembak Ikan

IDN LIVE

Daftar bisa langsung ke:

WhatsApp : 085222555128

“Fed officials have emphasized that they’re not in a rush to cut rates because they don’t know how the tariffs will exactly play through into the economy, but if you have even more upside risks to inflation, you’re probably looking at an end-of-year rate cut only,” he added.

ReplyDelete장수출장샵

구례출장샵

애인대행

애인대행

과천애인대행